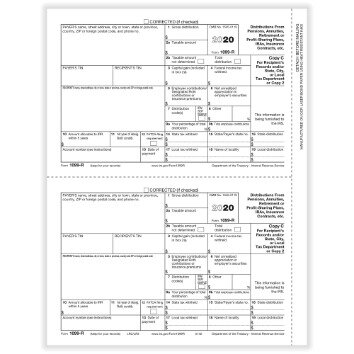

Code generally is used when the taxpayer is under 59 ½. See below for a chart of common IRS distribution codes found on 1099-R we send to policy owners.Įarly (premature) distribution, no known exception. In most cases, a 1035 exchange transaction is not taxable but is reportable and therefore a 1099-R is issued by the surrendering carrier.ĭistribution Codes – The code found in Box 7 of a 1099-R that indicates to the IRS the type of transaction reported in that tax year.

The exchange of an annuity contract for another annuity contract or qualified long-term care insurance policy is also a 1035 exchange. Taxable Amount – The total taxable amount of the distribution.Ĭost Basis -The contract holder’s investment in the policy (Also called the tax basis), on our records.ġ035 Exchange – The exchange of a life insurance policy for another life insurance policy, annuity contract, or qualified long-term care insurance contract issued by another life insurance company qualifies as a 1035 exchange. Gross Distribution – The total amount of the distribution, withdrawal, surrender, or 1035 exchange to a policy with another company. It is also used to report dividends earned when the total dividends paid to the owner have exceeded total premiums paid into the policy and used to report charges or payments on qualifying Long Term Care Services Riders and calling out that federal tax rules require insurers to report such amounts, but these amounts are not taxable.ġ099-INT Form – The tax form used to report interest credited on dividends left on deposit and interest on death claims.ġ099-MISC- The tax form used to report miscellaneous income for a tax year. If you are not registered for Equitable Client Portal, you can register here.īelow are key terms, definitions, and FAQ’s that will facilitate your understanding of the tax forms you have or will receive with respect to your life insurance policy or annuity contract.ġ099-R Form The tax form used to report taxable transactions for a life insurance policy or annuity (for example, gain on a surrender or certain lapses). Tax forms will be loaded under the eStatements tab. In order to retrieve your documents online, please login to your account online and enroll in eDelivery. Accordingly, 5498 tax forms are also made available online by logging into our website Equitable Client Portal ( Register Here) prior to being mailed to clients in May 2023. Please note that the IRS allows individuals to make non-rollover contributions to IRAs for 2022 up to the 2022 tax filing deadline, in April 2023. PAPER COPIES WERE SENT VIA REGULAR MAIL ON JANUARY 31 ST.Įquitable Financial annuity contract owners who made reportable contributions or rollovers into their IRA contracts in, or for tax year 2022, will receive a Form 5498 in accordance with IRS guidelines.

These tax documents will be made available online prior to being mailed, which will speed up the completion of your tax return.ġ099-R AND 1099-INT TAX FORMS FOR TAX YEAR 2022 WILL BE AVAILABLE ONLINE BY LOGGING INTO the EQUITABLE CLIENT PORTAL ON OR ABOUT THE 2nd WEEK OF FEBRUARY, 2023. Generally, the 1099-R and 1099-INT tax forms are made available via the Equitable Client Portal ( Register or Login Here) and mailed to clients by the end of January, following the tax year that just ended.įor the fastest access to your tax documents, Equitable strongly recommends logging in to your account through the Equitable Client Portal to retrieve your 1099-R and/or 1099-INT tax forms. Equitable life insurance and annuity policy owners, who had a taxable or reportable transaction in 2022 (for example, a surrender, withdrawal, 1035 exchange to a policy with another company, or the payment of most interest) will receive a 1099 tax form in accordance with IRS guidelines for tax reporting purposes.

0 kommentar(er)

0 kommentar(er)